There are many misconceptions about how marginal tax brackets work and how they impact your federal tax return. This is what you need to know:

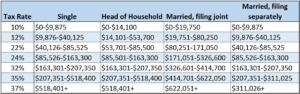

For the 2020 tax year (to be filed by in 2021), the IRS set marginal rates of 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax rate depends on your filing status (single, married filing jointly, married filing separately, or head of household) as well as your taxable income.

Taxable income, or Adjusted Gross Income (AGI), includes the sum of your wages, salaries, bonuses, tips, investment income, and unearned income minus any deductions or exemptions. A tax professional can assist you with your unique tax situation.

Taxable income is divided into tax rate thresholds for the different filing statuses, which are typically adjusted each year for inflation. Here are the thresholds for the 2020 tax year:

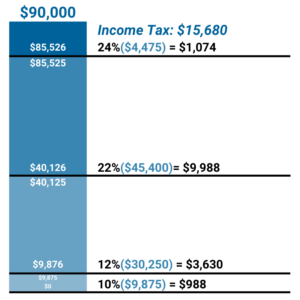

So how does that work? Take a look at this example of a single filer with $90,000 taxable income:

The first $9,875 of the filer’s income is taxed at 10%, which amounts to $988. Income between $9876 and $40,125 is taxed at 12%, which amounts to $3,630. Income within the next tax bracket is taxed at 22%, which amounts to $9,988. This filer only has $4,475 in income within the 24% tax bracket, which amounts to $1,074. This adds up to $15,680 owed in federal income tax.

The first $9,875 of the filer’s income is taxed at 10%, which amounts to $988. Income between $9876 and $40,125 is taxed at 12%, which amounts to $3,630. Income within the next tax bracket is taxed at 22%, which amounts to $9,988. This filer only has $4,475 in income within the 24% tax bracket, which amounts to $1,074. This adds up to $15,680 owed in federal income tax.

In simplified terms, when you prepare your annual tax return you are confirming that you paid your taxes appropriately throughout the year, such as through paycheck withholdings. You will receive a refund if you overpaid, and will owe money if you underpaid.